2Jour Gazette | Edition 6 | 28 Oct - 03 Nov 2024

- Maryna Borysenko

- Nov 4, 2024

- 14 min read

Welcome to this week’s edition of 2Jour Gazette—your curated look at what’s been making waves in fashion and luxury. This week wraps up the main Q3 financial results presentations for luxury (and non-luxury) groups, and I can finally breathe a sigh of relief. These endless numbers have been quite an eyesore over the past few weeks.

Nonetheless, the air is thick with anticipation—and maybe a little caffeine from political all-nighters—as the U.S. inches closer to its 2024 elections. The stage is set for a showdown featuring Vice President Kamala Harris and former President Donald Trump, with debates sparking both fierce opinions and viral moments. The U.S. market is not only one of the two main pillars for luxury but also a significant force that sets the agenda for the global system. So, we wait with bated breath for the results, while analyzing the outcomes of this week’s top performer—the Prada Group—where, despite collective sighs of admiration, I ponder whether everything is as straightforward as it seems.

In this edition, you’ll also find the conclusion of the Succession story at Estée Lauder (no, the main seat was not taken by a family member), a brilliant color playbook by Bottega Veneta, and, for those tired of the hustle, why not take a break with a children’s book from... Hermès?

So, grab your favorite espresso (or perhaps a glass of champagne), settle in, and let’s explore the chic, the influential, and the simply fascinating moments from the past week.

x Marina 2Jour

Temu Faces EU Probe Over Handling of Illegal Product Sales

Online retail platform Temu is set to face an investigation by the European Union (EU) over its handling of illegal product sales. This probe follows growing concerns about the sale of counterfeit and non-compliant goods on the platform, which has rapidly gained popularity across Europe.

The EU Commission announced it would review Temu’s practices to ensure compliance with regional safety standards and consumer protection laws. This action is part of a broader crackdown on e-commerce platforms accused of facilitating the distribution of illegal or unsafe products.

Margrethe Vestager, Executive Vice-President for a Europe Fit for the Digital Age, stated:

We want to ensure that Temu is complying with the Digital Services Act. Particularly in ensuring that products sold on their platform meet EU standards and do not harm consumers. Our enforcement will guarantee a level playing field and that every platform, including Temu, fully respects the laws that keep our European market safe and fair for all.

Temu operates primarily as a cross-border marketplace, sourcing a significant portion of its products from outside the EU. Critics argue that this model can facilitate the entry of items that do not meet EU safety and quality standards.

The investigation will focus on:

Vetting sellers: Ensuring proper background checks on vendors;

Product compliance: Removing non-compliant products swiftly;

Safety response: Addressing safety concerns in a timely manner.

If Temu fails to meet EU standards, potential outcomes include:

Fines

Stricter regulatory oversight

Possible ban from operating in the EU market

Temu has not yet issued a statement on the upcoming probe. The result of this investigation could significantly impact its operations and consumer trust in Europe.

PROFIT WATCH: TRACKING FINANCIAL WINS AND LOSSES

Miu Miu Outshines Big Sister Prada as Prada Group Reports Growth in a Challenging Market

30 Oct 2024. Prada Group remains resilient in the face of a weakened luxury market, thanks to the strong performance of the Miu Miu brand as it reports Q3 2024 revenues.

Over the first nine months of the year, Prada Groups’s net revenues increased by 17.7% at constant exchange rates, totaling €3.83 billion. Miu Miu alone contributed to this success with an astonishing 105% sales surge in the third quarter, nearly doubling its performance year-over-year and achieving a total of €854 million in revenue. Meanwhile, Prada brand recorded a modest 1.7% growth in retail sales, indicating a slowdown compared to earlier quarters.

Regional performance was varied but strong overall. In Asia-Pacific, sales rose by 12%, despite market challenges, confirmed by Group's CEO Andrea Guerra. European sales jumped by 18%, driven by both local shoppers and tourists, while Japan saw a 53% increase, though the pace slowed in the third quarter. Sales in the Middle East grew by 24%, and the Americas registered an 8% growth across the nine months.

By channel: Retail sales, which account for the majority of Prada’s revenue, grew by 18% at constant currency, while wholesale sales showed a steady 9% increase. Expanding Miu Miu is a strategic focus, with plans to enlarge stores and enter new regions, supported by the upcoming appointment of a new CEO. Miu Miu's previous CEO, Benedetta Petruzzo, who had been in the role since 2020, joined LVMH-owned Christian Dior as managing director on October 15, 2024.

You see: +105% growth in Miu Miu retail sales, Q3 2024 vs. Q3 2023.

I see: +2% growth in Prada brand retail sales, Q3 2024 vs. Q3 2023.

You see: Prada Group defies the luxury slowdown, with an 18% increase in total retail sales for 9M 2024 vs. 9M 2023 (the same +18% in Q3 2024 vs. Q3 2023).

I see: Prada accounts for 74% of Prada Group revenue, while Miu Miu represents 25% (back in 2021 it was 87% vs. 12%).

It’s not Prada Group as a whole that has cracked the code—particularly considering Prada’s more traditional luxury status, whereas Miu Miu is “experimental premium” (shifting toward luxury with recent price adjustments). This is a case of the right timing and the right market, and it will be intriguing to watch the brand’s mid-term development.

Still, Prada Group remains one of the few luxury fashion market players to have seen significant share price growth since the beginning of the year, with a current market capitalization of 152.4 billion HKD (approximately 18.29 billion euros), up 35.19% in 2024. The company last reached its peak in 2013.

Full presentation on Prada Group report is here.

Moncler Group Posts Mixed Results in 9M 2024 Performance

29 Oct 2024. Moncler Group disclosed its financial performance for the first nine months of 2024, achieving overall growth despite a dip in the third quarter. The Group's total revenue for 9M 2024 was €1,865.7 million, reflecting a 6% increase compared to the same period in 2023. However, Q3 2024 revealed a 3% decline, with revenues at €635.5 million, signaling challenges in a key quarter.

Moncler Brand posted revenues of €1,573.3 million for 9M 2024, representing an 8% increase year-over-year. Despite this solid growth, Q3 revenues dropped by 3%, amounting to €532.0 million, due in part to lower wholesale performance.

Stone Island faced a more difficult period, reporting €292.4 million in revenue for 9M 2024, marking a 5% decline compared to the prior year. Q3 figures also showed a 4% drop, with revenues totaling €103.6 million.

Performance by Channel:

Retail: The retail channel showed solid growth for 9M 2024, driven by strong performance in direct-to-consumer sales and increased foot traffic, particularly in flagship stores across EMEA and the Americas.

Wholesale: The wholesale channel faced challenges, with a notable decline in Q3 contributing to the overall slowdown. This was particularly impactful during the quarter that is usually the most significant for wholesale revenue.

Geographic Performance:

Moncler’s leadership pointed to the impact of global economic uncertainties on third-quarter performance, while reiterating the importance of strategic investments and innovation. The Group continues to focus on sustainability and enhancing premium customer experiences.

Outlook: While the company remains cautiously optimistic about future growth, it acknowledges the potential for continued volatility as it navigates shifting economic conditions.

See the full presentation here.

Next Boosts Profit Forecast After Strong Q3 Sales

30 Oct 2024. Next plc reported stronger-than-expected third-quarter results for 2024, driven by increased sales due to early winter demand and steady online growth. The company’s trading statement reveals a robust performance, with full-price sales surpassing forecasts, prompting Next to raise its profit outlook for the year.

Sales growth: Full-price sales increased by 7.6% year-over-year, exceeding the anticipated growth of 5%. This was driven in part by an early cold snap, which boosted demand for winter clothing.

Profit forecast update: Due to the strong quarter, Next raised its full-year profit before tax forecast from £995 million to £1.005 billion.

Online sales performance: Online UK sales grew by 7.9%, reflecting strong consumer demand in digital channels.

In-store sales growth: Physical store sales also saw growth, increasing by 2.9% over the period.

This balanced approach—leveraging both strong digital channels and steady in-store growth—positions it well to navigate economic uncertainties while sustaining long-term resilience and profitability.

Despite these gains, the retailer remains cautious in its outlook, citing economic uncertainties. See the trading statement here.

Puig Reports Strong Q3 2024 Performance with Double-Digit Growth

29 Oct 2024. Puig, the global beauty and fashion company, reported financial results for the third quarter of 2024, achieving a net revenue of €1,257 million. This represents an 11.6% like-for-like (LFL) growth and an 11.1% reported growth, surpassing the premium beauty market average.

Performance Highlights:

Fragrance and Fashion: The core business segment reported an 11.1% increase in Q3 revenue. Growth was driven by product launches such as Million Gold by Rabanne and Vénus by Nina Ricci, along with continued performance from Jean Paul Gaultier and Carolina Herrera’s Good Girl.

Makeup: The segment saw a 7.3% increase, supported by narrowing sell-in/sell-out differentials and solid results from Charlotte Tilbury, especially with the launch of Exagger-Eyes Mascara.

Skincare: Reported growth of 18.6%, aided by the integration and success of Dr. Barbara Sturm.

Geographic Strengths:

EMEA: Continued as Puig’s largest market, with a 13.9% increase in Q3 revenue;

Americas: Saw a 9.8% rise, bolstered by strong U.S. performance;

APAC: Recorded growth of 1.0%, indicating ongoing challenges in the region.

About Puig. Founded in 1914, Puig is a family-owned company active in the fragrance, fashion, makeup, and skincare sectors. Operating in over 150 countries, Puig’s brand portfolio includes Carolina Herrera, Jean Paul Gaultier, Charlotte Tilbury, and Nina Ricci.

See the full presentation here.

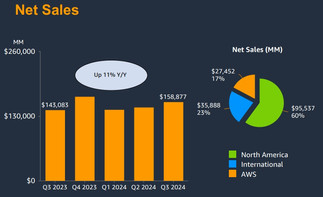

Amazon Reports Q3 2024 Financial Results with 11% Revenue Growth

Amazon has reported its third-quarter financial results for 2024, highlighting significant gains in revenue and profitability driven by robust e-commerce sales and cloud services.

Net sales increased 11% to $158.9 billion in the third quarter, compared with $143.1 billion in third quarter 2023. Excluding the $0.2 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 11% compared with third quarter 2023;

Operating income increased to $17.4 billion in the third quarter, compared with $11.2 billion in third quarter 2023;

Net income increased to $15.3 billion in the third quarter, or $1.43 per diluted share, compared with $9.9 billion, or $0.94 per diluted share, in third quarter 2023.

Performance Insights:

E-commerce: Amazon's core e-commerce segment experienced steady growth, boosted by Prime Day sales and increased consumer spending across global markets.

Advertising Services: Revenue from advertising services rose 22%, highlighting Amazon’s expanding influence in the digital advertising space.

CEO Andy Jassy commented, “Our Q3 results reflect the effectiveness of our investments in innovation and customer experience. AWS continues to be a strong driver of growth, and we’re seeing positive momentum in our e-commerce and advertising segments.”

Outlook: Amazon raised its revenue forecast for Q4 2024, anticipating strong holiday season performance and continued gains in AWS and advertising. The company remains focused on enhancing customer experiences and expanding its global logistics network.

I'm wondering if we are going to see anyone in luxury beauty apart from Estee Lauder at Amazon any time soon. I have a feeling Dr. Barbara Sturm (Puig-owned) would be a perfect fit.

See the Q3 2024 presentation here.

THE JOB SHIFT JOURNAL: HIRES, FIRES & TRANSITIONS

Estée Lauder Succession: De La Faverie Named CEO

30 Oct 2024. The Estée Lauder Companies Inc., a global player in beauty, announced a significant leadership transition that will see Stéphane de La Faverie take over as President and CEO starting January 1, 2025.

This move represents a strategic evolution for the company, as the Lauder family—who founded the iconic brand nearly 80 years ago—shifts away from daily management responsibilities to focus on long-term strategic oversight. William P. Lauder, the grandson of founder Estée Lauder, will step down as Executive Chairman on November 8 but will continue as Chair of the Board of Directors.

De La Faverie, a seasoned executive and industry veteran with over 25 years in luxury beauty, currently serves as Executive Group President. He joined Estée Lauder in 2011 and has since overseen key brands like Estée Lauder, Jo Malone London, The Ordinary, and Le Labo. De La Faverie has been central in implementing the company’s Profit Recovery and Growth Plan—a strategy designed to revitalize Estée Lauder’s profitability and drive sustainable growth amid challenging market conditions.

This transition marks a carefully structured succession plan, where de La Faverie will work closely with outgoing CEO Fabrizio Freda, who has led the company for over 16 years, ensuring continuity and stability as the company navigates its current challenges. Freda, who announced his retirement earlier this year, has been instrumental in building Estée Lauder’s global footprint and guiding it through periods of growth and transformation.

A New Chapter for the Lauder Family

The shift also signifies a new chapter for the Lauder family. William P. Lauder’s decision to step down from his executive role and focus on his position as Chair of the Board underscores the family’s commitment to preserving the company’s legacy while adapting to the demands of a fast-evolving luxury market.

Our family’s day-to-day involvement in company management is evolving, reflecting our desire to focus more on long-term strategy,

—said William P. Lauder. He added that the family remains committed as long-term stakeholders, bringing their values and investment perspective to the company’s governance.

Jane Lauder, another prominent family member and granddaughter of Estée Lauder, will also step down from her operational roles at the end of the year. This shift signals the family’s intention to allow a new generation of leaders to steer the company while preserving their influence over strategic decisions.

Challenges Ahead and De La Faverie’s Vision

This leadership change comes at a challenging time for Estée Lauder. In the first quarter of fiscal 2025, the company reported a 4% decline in net sales to $3.36 billion, with organic net sales decreasing by 5%. The downturn is largely attributed to weak consumer sentiment in Mainland China and a slump in travel retail sales across Asia. Consequently, Estée Lauder has withdrawn its full-year earnings forecast and reduced its quarterly dividend to 35 cents per share.

Future Plans of New CEO

De La Faverie aims to reestablish Estée Lauder as a leader in luxury beauty through a balanced approach of innovation and heritage. His vision includes a strong push for groundbreaking product innovation, memorable consumer experiences, and data-driven marketing strategies to engage a diverse consumer base, from Gen Z to traditional luxury buyers. The goal is to revitalize the company’s growth trajectory while driving shareholder value.

***

This leadership transition marks a transformative moment for Estée Lauder as it positions itself to tackle financial challenges and strengthen its foothold in the competitive beauty market. With de La Faverie at the helm, backed by the strategic support of the Lauder family and board, Estée Lauder embarks on a new era focused on resilience, innovation, and sustainable growth.

See the full press-release here.

Boohoo Appoints Insider as CEO in Snub to Mike Ashley

01 Nov 2024. Boohoo, the UK fast-fashion retail group, has announced the appointment of Dan Finley, who runs Boohoo-owned Debenhams, as its new Group Chief Executive, effective immediately. This decision comes as a pointed move amid rising tensions with Mike Ashley’s Frasers Group, Boohoo’s largest shareholder.

The leadership change follows the departure of John Lyttle earlier in October and highlights Boohoo’s choice to promote from within, bypassing Ashley’s demands to be installed as the group’s CEO. Frasers Group has been vocal about its dissatisfaction, accusing Boohoo of mismanaging its operations and eroding shareholder value.

Boohoo has faced challenges with fluctuating sales and post-pandemic shifts in consumer behavior, alongside ongoing scrutiny for its sustainability practices. The company’s recent performance has shown strain, with sales and profitability under pressure amid a competitive market.

With Finley at the helm, Boohoo aims to strengthen its strategic direction, enhance supply chain transparency, and address investor concerns.

THE BUZZ: Marketing & Collab Chronicles

Embracing Luxury from Day One: The Loro Piana Stroller

Loro Piana and Inglesina have partnered to produce a stroller that merges Loro Piana's textile craftsmanship with Inglesina's baby carriage engineering. The stroller incorporates Loro Piana's fabrics, known for their quality and durability, into Inglesina's established design. This collaboration focuses on creating a high-end product that caters to parents looking for premium options in child mobility equipment. The stroller’s design highlights practical features and refined materials, emphasizing functional use with a nod to luxury. This partnership reflects a trend of combining fashion and function in baby gear, appealing to consumers interested in both aesthetics and performance.

Inglesina: An Italian company specializing in baby strollers and child mobility solutions, known for blending engineering expertise with comfort-focused design.

Brands like Fendi, Gucci, Dior, and Versace have previously ventured into the stroller market, offering designs generously adorned with their brand logos. The reason why the more understated and elegant model from Loro Piana appeals to me more. I would also love to see a stroller from Hermès – I believe it would be something truly beautiful (without the logos, please).

Stitch the Dog and Magic Threads: Hermès Debuts in Children’s Literature

A Hermès stroller would be an even better idea, as the brand has recently ventured into... children's books and comics. Last week, I mentioned the first edition of Le Monde d'Hermès that I ever held in my hands, and I completely fell in love with their storytelling and the editor's approach. I’m that annoying person who actually flips through brand magazines (I wasn’t impressed with the Louis Vuitton magazine I picked up a while ago at a boutique—it felt like they released it just for the sake of releasing something). This week, there’s even more news from Hermès in the world of literature.

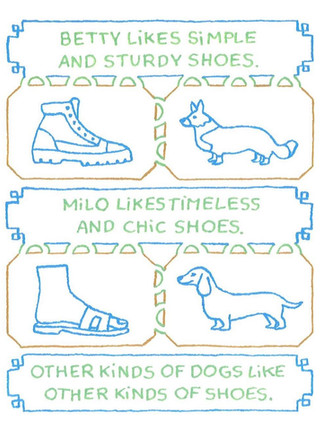

Whimsical Comic Series on Dogs and Shoes

What do poodles, dachshunds, and Great Danes have their eyes on most often? Shoes, of course! Hermès has introduced a playful comic series where dogs share their preferences for luxury footwear. Illustrated by the talented Juliette Green, the series is a charming mix of elegance and fun, showing pooches prancing around Hermès' finest shoes. Isn’t it a delightful way for the brand to showcase its playful side to readers of all ages?

First-Ever Picture Book: “Lanterne Magique”

The brand has taken a leap into the world of children’s storytelling with its first picture book, “Lanterne Magique.” Written and illustrated by the creative duo Kenji Oikawa and Mayuko Takeuchi of 100%ORANGE, this captivating tale promises a blend of wonder, whimsy, and a touch of French flair.

The story introduces readers to a spool of thread—an unexpected hero who embarks on an adventure that begins on a craftsman’s desk and gradually opens up into a world of light, shadows, and hidden surprises. Along the way, familiar faces make an appearance, such as the reserved old man and Stitch the dog (isn’t the name wonderfully thoughtful?), adding their charm to the unfolding narrative.

Inspired by Oikawa’s visits to Hermès' leather and silk workshops in Paris and Lyon, the book captures the enchantment of artisans’ tools, the quiet beauty of their workspaces, and the essence of French craftsmanship. With illustrations that shift perspective from a desk surface to an entire shop, young readers are invited to see the world from a fresh angle.

Currently, “Lanterne Magique” is exclusively available in Japan, inviting young readers and their families to experience Hermès' whimsical side through this special story. What a perfect way to introduce Hermès to little ones from an early age (the brand definitely perfected the art of storytelling).

THE LOUNGE: Campaigns, Lookbooks, Edits

Color Play Perfected: Bottega Veneta Resort 2025

In the fast-paced luxury fashion industry, resort lookbooks have become a staple. Yes, it seems like we just saw the spring collections only a month ago, and now it’s already time for Resort. One lookbook you’ll want to revisit over and over to catch every detail is Bottega Veneta’s Resort 2025 collection. The colors are masterfully combined, striking that perfect balance—not too loud, not too dull.

What caught my eye, however, was the abundance of exotic leather—a choice that feels more like a communication faux-pas than a thoughtful way to present an otherwise truly stunning collection.

Stay tuned for the next week edition x